Table of Contents

The article ‘Navigating Tennessee Property Data: A Comprehensive Guide’ offers an in-depth exploration of the various aspects of property data within the state of Tennessee. It serves as an essential resource for anyone looking to understand property records, utilize online data resources, recognize the roles of different agencies, analyze market trends, and comprehend legal considerations related to property. By delving into each of these areas, the guide aims to equip readers with the knowledge and tools necessary to effectively manage and research property-related information in Tennessee.

Key Takeaways

- A clear understanding of Tennessee property records, including types and how to interpret them, is crucial for property management and research.

- Online resources, such as statewide portals and GIS tools, provide accessible and detailed Tennessee property data for public use.

- Public and private agencies play distinct roles in maintaining property data, with each offering different types of information and services.

- Market trends and property values in Tennessee can be analyzed through various data sources, which are instrumental in real estate decision-making.

- Legal considerations, including zoning laws and property rights, are key factors that affect property ownership and transactions in Tennessee.

Understanding Tennessee Property Records

Types of Property Records Available

In Tennessee, a variety of property records can be accessed to provide detailed information about real estate ownership and transactions. Property deeds, which signify the transfer of ownership, are the most commonly sought-after documents. These records are essential for confirming legal ownership and tracing the history of a property.

Other key records include:

- Title records that show the legal right to possess or use property.

- Mortgage documents which detail the financing aspects of property purchases.

- Liens that indicate claims against the property due to debts.

- Easements that outline the rights of non-owners to use the property for specific purposes.

It is crucial to understand the different types of property records to effectively navigate the real estate landscape in Tennessee. Each record serves a unique purpose and provides specific information that can impact the buying or selling process.

Accessing County Assessor’s Databases

Each county in Tennessee maintains a database of property records that is managed by the County Assessor’s office. Accessing these databases is crucial for obtaining detailed property information, including ownership, valuation, and taxation data. To facilitate this, most counties offer online portals where individuals can search for property data using various criteria such as owner name, address, or parcel number.

- Visit the County Assessor’s website for the county in which the property is located.

- Navigate to the property search or database section.

- Enter the search criteria to locate the specific property records.

- Review the available property details and reports.

It is important to note that while most county databases are accessible online, the level of detail and user-friendliness can vary significantly from one county to another. Users may need to familiarize themselves with each county’s system to efficiently extract the needed information.

Interpreting Property Legal Descriptions

Interpreting property legal descriptions is crucial for understanding the exact boundaries and location of a property. These descriptions are a detailed way of describing a property’s location without relying on the physical address, which can be ambiguous or subject to change. Legal descriptions are often found in deeds, mortgages, and other legal documents.

- Metes and Bounds: This system uses physical features of the local geography, along with directions and distances, to define the boundaries of a parcel of land.

- Rectangular Survey System: Also known as the Public Land Survey System, it divides land into townships and sections.

- Lot and Block: Common in residential areas, this system refers to a specific lot number within a subdivision as recorded on a plat map.

Understanding how to read and interpret these descriptions is essential for anyone involved in real estate transactions, land development, or property litigation. Accurate interpretation can prevent legal disputes and ensure clear property rights.

Online Resources for Tennessee Property Data

Statewide Portals and Databases

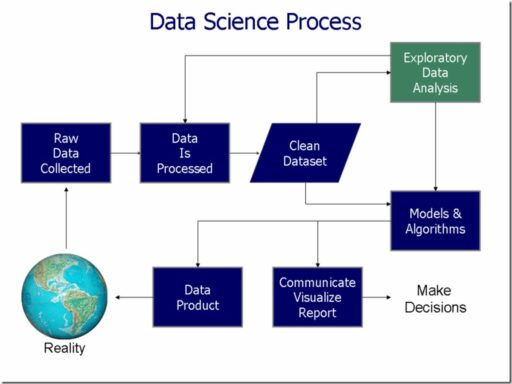

For those seeking comprehensive property data across Tennessee, statewide portals and databases offer a centralized solution. These resources provide a wealth of information, ranging from ownership details to historical property values, all accessible with a few clicks.

- Tennessee Real Estate Assessment Data System (TREADS)

- Tennessee Property Data Portal (TPDP)

- Tennessee GIS Services and Maps

Each of these platforms has its own set of features and data points, making it crucial for users to understand how to navigate them effectively. For instance, TREADS is known for its detailed assessment records, while TPDP offers user-friendly search functions for general property information.

It’s essential to recognize the importance of these databases in facilitating real estate transactions, urban planning, and economic development within the state.

Navigating the Tennessee Property Data Dashboard

The Tennessee Property Data Dashboard is an invaluable tool for homeowners, real estate professionals, and researchers looking to access comprehensive property information. Navigating this dashboard requires an understanding of its various features and functionalities.

To effectively use the dashboard, follow these steps:

- Identify the county of interest, as data is often organized by county jurisdictions.

- Utilize the search function to find specific properties using criteria such as address, owner name, or parcel number.

- Explore the interactive map to view property boundaries, geographic features, and overlays of demographic data.

The dashboard’s user-friendly interface allows for the customization of data displays and reports, making it easier to analyze and interpret property data specific to your needs.

Remember that while the dashboard provides a wealth of information, it may not include all the details found in official records. For complete data, consider contacting the county assessor’s office directly.

Utilizing GIS and Mapping Tools

Geographic Information Systems (GIS) and mapping tools are invaluable for visualizing Tennessee property data in a spatial context. These tools enable users to overlay various data sets, such as zoning information, floodplains, or demographic statistics, providing a comprehensive view of the property landscape.

- Identify property boundaries and geographical features

- Analyze spatial relationships and patterns

- Access environmental and infrastructural information

By leveraging GIS and mapping tools, stakeholders can make informed decisions based on the spatial analysis of properties, which can reveal insights not immediately apparent through traditional data review methods.

The integration of GIS technology has revolutionized the way property data is analyzed and interpreted. It allows for a more dynamic and interactive approach to property research, which can be particularly useful for professionals in real estate, urban planning, and environmental assessment.

The Role of Public and Private Agencies

Tennessee Register of Deeds

The Tennessee Register of Deeds is a pivotal public agency responsible for recording and maintaining records related to real property in the state. Each county has its own Register of Deeds, which serves as the official custodian of documents such as deeds, mortgages, and easements. These records are crucial for establishing property ownership and are accessible to the public.

The integrity of property transactions largely depends on the meticulous records kept by the Register of Deeds. It is essential for anyone involved in real estate to understand how to navigate these records effectively.

Here is a list of common documents managed by the Tennessee Register of Deeds:

- Warranty Deeds

- Trust Deeds

- Release Deeds

- Power of Attorney

- Plat Maps

- Military Discharges

When engaging with the Register of Deeds, it’s important to have a clear understanding of the specific document you are seeking and the relevant transaction date. This will streamline the search process and ensure that you can obtain the necessary information with minimal delay.

Real Estate Data Providers

In the realm of Tennessee property data, real estate data providers play a pivotal role. These entities collect, curate, and distribute information that is crucial for various stakeholders, including investors, realtors, and homebuyers. They offer a range of services from detailed property reports to comprehensive market analyses.

- CoreLogic – Offers analytics and data-driven insights.

- Zillow – Provides listings and estimated market values.

- Realtor.com – Lists properties and offers market trend data.

- Redfin – Combines brokerage services with online data tools.

Real estate data providers bridge the gap between raw data and actionable insights, enabling informed decision-making in the property market.

The data provided by these companies can vary significantly in terms of depth, geographic coverage, and timeliness. It’s essential for users to understand the strengths and limitations of each source to effectively utilize the information for their specific needs.

Government vs. Commercial Data Sources

When researching Tennessee property data, individuals have the option to use government or commercial data sources. Government sources are typically free and considered authoritative, as they are maintained by public agencies. On the other hand, commercial data providers offer enhanced services, such as user-friendly interfaces and additional data analytics, but often at a cost.

- Government Sources: Often free, authoritative, may have limited user interfaces.

- Commercial Sources: User-friendly, additional analytics, usually require a subscription or fee.

It’s essential to weigh the pros and cons of each source type. Government databases are reliable for legal documentation, while commercial sources can save time and provide extra insight for market analysis. Choosing the right source depends on the specific needs and goals of the user.

Analyzing Market Trends and Property Values

Understanding the Tennessee Housing Market

The Tennessee housing market has shown remarkable resilience and growth over the past few years, with trends indicating a continued demand for residential properties. Key economic indicators such as employment rates, population growth, and interest rates play a pivotal role in shaping the market dynamics.

- Nashville and Memphis have been hotspots for real estate investment, reflecting a surge in median home prices.

- Suburban and rural areas are also experiencing a rise in property values, as more people seek spacious living environments.

- The rental market remains robust, with urban centers seeing high demand for apartments and condos.

The interplay between supply and demand, along with state-specific factors such as tax incentives and infrastructure development, significantly influences property values across Tennessee.

Understanding these trends is crucial for investors, homebuyers, and policymakers to make informed decisions. The market is complex and multifaceted, with various segments reacting differently to economic pressures. For instance, luxury properties may not follow the same trends as mid-range or affordable housing sectors.

Assessment of Property Taxes and Their Impact

Property taxes in Tennessee are a critical source of revenue for local governments, funding essential services such as education, public safety, and infrastructure. The assessment of property taxes is based on the appraised value of the property, which is determined by the county assessor’s office.

- Property tax rates vary by county and are expressed in terms of dollars per hundred or thousand dollars of assessed value.

- Tax assessments are conducted periodically, with some counties reassessing property values annually, while others may do so less frequently.

- Property owners have the right to appeal their property tax assessments if they believe they are inaccurate or unfair.

The impact of property taxes extends beyond the individual homeowner, influencing the local economy, housing affordability, and community development. Higher property taxes can lead to increased housing costs, potentially affecting the rental market and homeownership rates.

Understanding the nuances of property tax assessments can help property owners budget for this expense and identify opportunities for tax relief or exemptions that may be available to them.

Forecasting Future Property Values

Forecasting future property values in Tennessee requires a nuanced understanding of various market dynamics and trends. Economic indicators, population growth, and housing demand are key factors that can influence property valuations over time.

- Review historical price trends and growth rates

- Analyze economic and demographic data

- Consider the impact of new developments and infrastructure

- Monitor changes in local and state regulations

Accurate forecasting hinges on the ability to synthesize data from multiple sources and to understand the local real estate cycle. While no prediction is foolproof, a well-researched forecast can be a valuable tool for investors, homeowners, and policymakers.

It’s also important to recognize the role of emerging technologies and data analytics in enhancing the accuracy of property value forecasts. By leveraging advanced modeling techniques and machine learning algorithms, analysts can better anticipate market shifts and valuation changes.

Legal Considerations and Property Rights

Zoning Laws and Regulations

In Tennessee, zoning laws play a crucial role in determining how property can be used. These regulations are established by local governments and dictate the types of structures that can be built, the purposes for which buildings may be used, and the overall layout of the community. Understanding these laws is essential for property owners and developers to ensure compliance and to optimize the use of their property.

- Residential zones typically allow for single-family homes, duplexes, and apartments.

- Commercial zones are designated for businesses, such as retail stores and offices.

- Industrial zones are reserved for manufacturing and other industrial uses.

- Agricultural zones protect farmland and control the development of rural areas.

It’s important to note that zoning regulations can have a significant impact on property values. A change in zoning can either increase or decrease the potential value of a property, depending on the nature of the change and the market demand for the newly permitted use.

Eminent Domain and Property Disputes

Eminent domain is a legal principle that allows government entities to acquire private property for public use, provided the owner is given just compensation. This process can lead to disputes, particularly regarding the amount of compensation or the definition of ‘public use’. Understanding your rights is crucial when facing a potential eminent domain case.

In Tennessee, property owners are entitled to receive the fair market value for their property, which is often a point of contention. The negotiation process can be complex, and property owners may need to seek legal counsel to ensure their interests are protected.

- Determine the fair market value of your property

- Understand the legal basis for the taking

- Seek legal advice if necessary

- Negotiate compensation

- Consider the long-term impact on your property rights

Disputes can also arise from property boundaries, easements, and other issues that affect property rights. Resolving these disputes often requires a clear understanding of both the law and the specific circumstances of your property.

Navigating Property Inheritance and Ownership Transfers

When navigating property inheritance and ownership transfers in Tennessee, understanding the legal processes involved is crucial. Probate court proceedings often govern the transfer of property after an owner’s death, which can be complex and time-consuming.

- Determine if the property is part of a will or trust.

- Understand the role of executors or trustees in transferring property.

- Familiarize yourself with Tennessee’s laws on intestate succession for cases without a will.

It’s essential to consult with a legal professional to ensure all steps are properly followed and to address any potential tax implications.

Additionally, when transferring ownership through sale or gift, it’s important to prepare and file the appropriate deeds. Clear title and the resolution of any liens or encumbrances are necessary to facilitate a smooth transfer.

Conclusion

Navigating Tennessee property data can initially seem daunting, but with the right resources and understanding, it becomes an empowering tool for homeowners, investors, and professionals alike. Throughout this comprehensive guide, we’ve explored the various aspects of property data, from accessing public records to understanding market trends. We’ve also delved into the nuances of property valuation and the importance of staying informed about local regulations. Whether you’re conducting research for a potential investment or simply keeping track of your property’s value, the insights provided here should serve as a valuable roadmap. Remember, the key to effectively navigating property data lies in diligence, continuous learning, and leveraging the wealth of information available at your fingertips. With this guide as your companion, you’re well-equipped to make informed decisions about Tennessee real estate.

Frequently Asked Questions

What types of property records can I find in Tennessee?

In Tennessee, you can find various types of property records including deeds, mortgage documents, easements, and property tax assessments. These records provide details about property ownership, boundaries, and value.

How can I access property records through a County Assessor’s database in Tennessee?

You can access property records by visiting the website of the County Assessor’s office in the county where the property is located. Many counties offer online databases where you can search for property information using the owner’s name, address, or parcel number.

What is a property legal description and how do I interpret it?

A property legal description is a written statement that uniquely identifies a piece of real property. It includes references to lot numbers, subdivision names, block numbers, survey systems, and metes and bounds. Interpreting this description usually requires understanding surveying terms and may involve consulting a professional surveyor or attorney.

Are there statewide portals for accessing Tennessee property data online?

Yes, Tennessee offers statewide portals such as the Tennessee Property Data Dashboard, where users can access a variety of property data, including ownership, valuation, and tax information across multiple counties.

What is the difference between public and private agencies in providing property data?

Public agencies, like the Tennessee Register of Deeds, provide official property records and are often free or have a nominal fee. Private agencies may offer additional services such as detailed property reports, analytics, and market trends, typically at a cost.

How can zoning laws affect property rights in Tennessee?

Zoning laws in Tennessee regulate land use and development. They can affect property rights by determining what types of structures can be built, property usage, and modifications that can be made to the land. It’s important to review local zoning ordinances to understand the restrictions and allowances for a particular property.